Best Jewelry Investment Pieces for Lasting Value

Share

When you think of the best jewelry investment pieces, your mind might jump to signed items from iconic houses like Cartier or Van Cleef & Arpels, classic diamond solitaires backed by GIA certification, and substantial high-karat gold. You'd be right. These pieces hold their value—and often appreciate—because of their rarity, brand recognition, and intrinsic material worth.

Unlike a trendy accessory that loses its appeal after a season, these are tangible assets. They have staying power.

Thinking Beyond Sparkle: How Jewelry Becomes an Asset

To spot a true investment, you have to learn to see jewelry as more than just a beautiful object. It's about shifting your perspective from appreciating temporary sparkle to recognizing lasting financial worth. Think of it like investing in fine art or a classic car; the value goes much deeper than what you see on the surface.

This value isn’t just a matter of opinion. It’s built on a foundation of specific, measurable factors that separate a fleeting fashion from a genuine asset. The real key is understanding what gives a piece its enduring power in the market.

Core Drivers of Jewelry's Asset Value

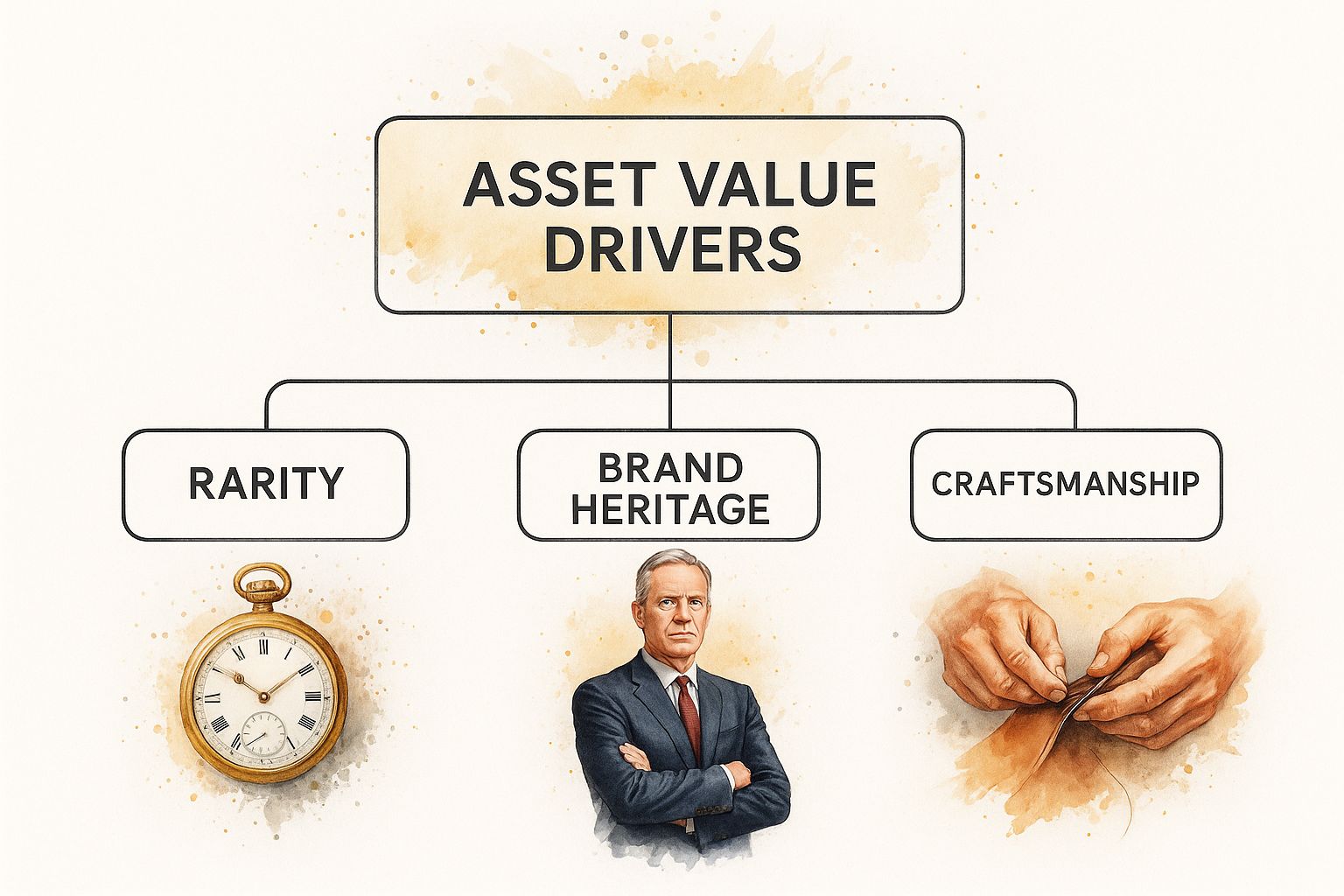

Three main pillars lift a piece of jewelry from a simple purchase to a strategic asset: rarity, brand heritage, and exceptional craftsmanship. Each one adds a distinct layer of value that can compound over time, ensuring the piece remains desirable for generations to come.

True investment-grade jewelry always has a story. Whether it's the legacy of a famed designer or the scarcity of a particular gemstone, this narrative is a crucial part of its long-term value.

This infographic breaks down how these three core drivers work together to turn a piece of jewelry into a valuable asset.

As you can see, these foundational elements are what create appreciating value. This framework helps you look past the raw materials and assess a piece’s true potential.

The global luxury jewelry market, home to these investment-grade items, was valued at roughly $48.74 billion and is expected to hit $99.15 billion by 2033. This isn't just a niche hobby; as you can read in this market report on GlobeNewswire, there's a growing global trend of viewing high-end jewelry as a stable financial asset.

Getting this perspective is the first step. You start to weigh potential buys based on their long-term performance, not just how they look today. That's how you build a collection that’s not only stunning but also financially smart.

Quick Guide to Investment-Grade Jewelry

To help you get started, this table summarizes the key categories of investment-worthy jewelry and what gives them their value.

Jewelry Type |

Primary Value Driver |

Best For |

|---|---|---|

Signed Heritage Pieces |

Brand Recognition & Rarity |

Collectors seeking established, auction-proven value. |

Certified Solitaire Diamonds |

Gemstone Quality & Certification |

Investors wanting a stable, liquid asset with clear grading. |

High-Karat Gold |

Intrinsic Metal Value |

Those looking for a direct hedge against inflation. |

Rare Colored Gemstones |

Scarcity & Demand |

Sophisticated investors comfortable with a less liquid market. |

Each of these categories offers a different path into jewelry investment, from the tangible security of gold to the high-stakes world of rare gems and iconic designer pieces.

The Four Pillars of Real Jewelry Value

When you start to look at jewelry as more than just an accessory, you realize its value isn't based on one single thing. Instead, there are four key elements that work together to create real, lasting worth. Think of them as the legs of a sturdy table—if one is weak, the whole thing is wobbly.

Mastering these four concepts is what separates a casual buyer from a truly savvy investor. They are Materials, Craftsmanship, Rarity, and Provenance. The pieces that become serious investments almost always shine in several of these areas, not just one.

Intrinsic Material Value

This is the most straightforward place to start. It’s simply the raw, inherent value of the metals and gemstones used to create the piece. Honestly, without top-tier materials, you can pretty much forget about long-term investment potential.

For metals, you want to see high-purity gold (think 18k or higher) or platinum. Their value is directly pegged to the global commodities market, which gives you a solid, reliable floor for the piece's worth. When it comes to gemstones, particularly diamonds, the industry standard is the "4 Cs":

-

Cut: This is all about the diamond's angles and facets. A masterful cut is what gives a diamond its fire and brilliance.

-

Color: How colorless is the diamond? This is graded on a scale from D (perfectly colorless) to Z.

-

Clarity: A measure of the tiny imperfections, both internal (inclusions) and external (blemishes).

-

Carat: Simply the weight of the diamond. Larger, high-quality stones are exponentially rarer and more valuable.

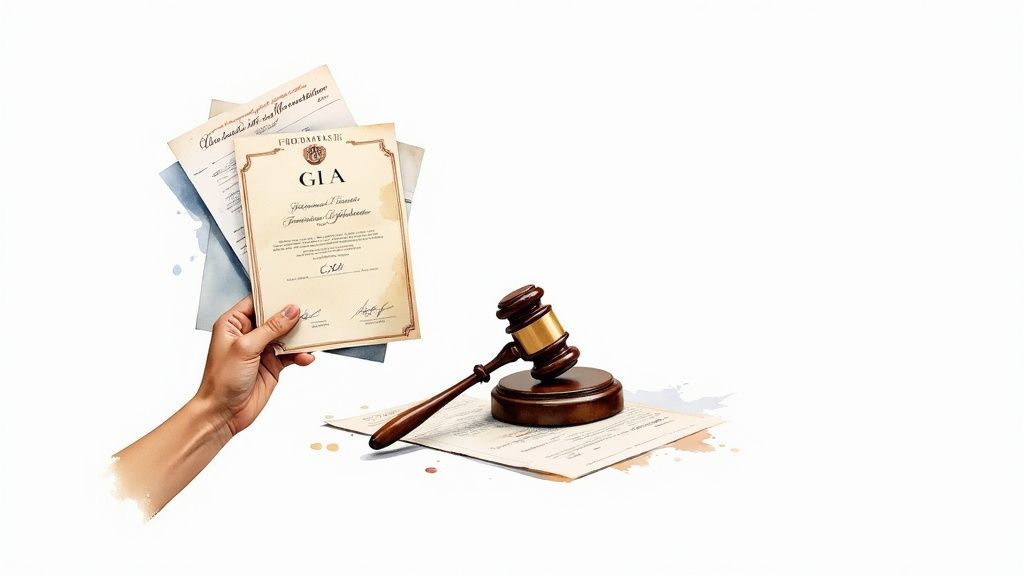

Here’s a non-negotiable rule: a diamond without a certificate from a respected lab like the GIA is a huge gamble. Without that paper, its material value is just an opinion, not a fact.

Exceptional Craftsmanship

Craftsmanship is where the human touch comes in—it’s the artistry, skill, and sheer effort that turns a pile of precious materials into something breathtaking. This is what separates a mass-produced trinket from a genuine work of art, and it adds a premium that goes way beyond the simple cost of the gold and gems.

I like to use a painting analogy: two artists can start with the exact same canvas and paints, but one creates a masterpiece while the other makes a forgettable decoration. The same is absolutely true for jewelry. You can see exceptional craftsmanship in the tiny details—the way stones are set seamlessly, the perfect polish, and the fluid, elegant lines of the design.

Scarcity and Rarity

The classic rule of supply and demand is a huge driver of value here. When something is hard to get, people naturally want it more, and the price goes up. Simple as that. In jewelry, rarity can pop up in a few different ways.

It might be a limited-edition piece from a legendary design house or a beautiful antique from a coveted era like Art Deco. Rarity is also the name of the game for fine colored gemstones. Unlike diamonds, gems like untreated Burmese rubies or Kashmir sapphires are found in just a handful of places on Earth, and many of those mines are now depleted. Their finite supply guarantees that top-quality examples will always be in demand.

A piece’s value is fundamentally tied to its scarcity. An item anyone can buy off the shelf is a commodity; an item that is one of a handful is a collectible.

Powerful Provenance

The last pillar, and often the most fascinating, is provenance. This is the piece’s life story—its documented history of ownership, its origins, and where it has been. This is the X-factor that can launch a valuable piece into the stratosphere, making it legendary.

A Cartier necklace is valuable on its own. But what about that same Cartier necklace that was once owned by Elizabeth Taylor or a European royal? Its value can multiply many times over. Provenance adds a unique story that no other piece on earth can replicate. The key, of course, is documentation. Original receipts, certificates of authenticity, and auction catalogs all build a rock-solid case for a piece’s story and its investment potential.

So, Which Pieces Are Actually Worth Investing In?

Now that we've covered what gives a piece of jewelry its value, let's get to the good stuff—the specific items that have proven their mettle as solid investments time and time again. Think of these as the "blue-chip stocks" of the jewelry world. They're the tried-and-true categories that not only hold their value but often appreciate, making them smart additions to any portfolio of tangible assets.

This isn't just a happy accident. Their lasting appeal comes down to timeless design, incredible materials, and a strong, established demand on the secondary market. In fact, the luxury fine jewelry world is booming, with forecasts from Future Market Insights projecting growth from $51.83 billion to $92.83 billion in the next decade. That staggering number shows just how much appetite there is for pieces that are both beautiful and a genuine store of value.

Classic Diamond Solitaires

If you're looking for the most iconic and easily liquidated jewelry investment, a high-quality diamond solitaire is it. It’s wonderfully straightforward. Its value is tied directly to the quality of that single, brilliant stone. For an investment, you want to focus on diamonds that are truly exceptional.

Here’s what to look for:

-

GIA Certification: This is non-negotiable. A report from the Gemological Institute of America is the gold standard, providing an unbiased and globally recognized grade of the diamond’s 4 Cs.

-

An Excellent Cut: A cut grade of "Excellent" or "Ideal" is crucial. This ensures the diamond has that breathtaking sparkle and fire everyone is after.

-

Top-Tier Color and Clarity: Stick to the colorless range (D-F) and aim for clarity grades of VS2 or higher. This guarantees the stone is visually pristine and genuinely rare.

Signed Jewelry from the Great Houses

Pieces from legendary names like Cartier, Van Cleef & Arpels, Bulgari, and Tiffany & Co. command a premium that goes far beyond the metal and gems they're made of. This "brand equity" is a massive driver of value. Collectors hunt for these iconic designs, and the name itself acts as a built-in guarantee of quality and authenticity.

A signed piece from a top-tier brand is like a painting with a confirmed artist. That signature—or hallmark—instantly elevates its status and resale potential.

Just look at the Cartier Love Bracelet. It often resells for close to its original retail price, which is almost unheard of in the jewelry world. When you’re buying signed pieces, always look for crisp, clear brand hallmarks and try to get the original box and papers if you can.

High-Karat Gold Chains and Bracelets

If you want a direct play on the value of precious metals, you can't go wrong with solid, high-karat gold. Unlike trend-driven, delicate items, a substantial chain or bracelet in 18k or 22k gold has a powerful intrinsic value that moves with the commodity market. It’s essentially a beautiful, wearable form of bullion.

Here, your focus should be on two things: weight and purity. While a good design makes it more enjoyable to wear, the investment power comes from the sheer amount of gold. A simple, elegant piece like a classic gold bracelet is a perfect foundation for an investment collection, giving you both style and substance.

Rare Colored Gemstones

For the more seasoned investor ready to play in the big leagues, rare colored gemstones offer incredible potential for appreciation. We're talking about untreated Burmese rubies, Kashmir sapphires, and Colombian emeralds—stones that are exceptionally scarce and fiercely sought-after. Their supply isn't just limited; in many cases, it's dwindling.

When you venture into colored gemstones, certification from a top lab like Gübelin or SSEF is absolutely essential. The lab report will confirm the stone’s origin and—most importantly—whether it's been treated, two factors that dramatically alter its value. The market for these gems isn't as liquid as the one for diamonds, but for the right stone, the returns can be truly extraordinary.

How to Navigate the Jewelry Market

Finding a piece of jewelry with real investment potential is just the first step. The real art lies in knowing how to buy and sell it intelligently. That’s how you protect your money and set yourself up for future gains. The market can feel a little intimidating, but with the right game plan, you can operate with the confidence of a seasoned pro.

Think of it like navigating a high-stakes art fair. You wouldn't just grab a painting off the wall without checking the gallery's reputation or the artist's signature. The exact same logic applies here—trust, documentation, and a clear strategy are your best friends.

Where to Buy Investment-Grade Jewelry

The very first decision you'll make—where to buy—is a big one. Your source has a massive impact on the piece's authenticity, quality, and, of course, its price. It’s crucial to sidestep impulse buys from unverified sellers and stick to established, reputable channels.

Here are the go-to venues for smart buyers:

-

Reputable Auction Houses: Giants like Sotheby's and Christie's are the gold standard for vetted, rare, and historically important jewelry. Their in-house specialists provide painstaking condition reports and research the piece's history, or provenance.

-

Trusted Estate Dealers: These are the experts who acquire jewelry from private collections. A good dealer builds their business on reputation and deep connections, often turning up incredible pieces you'd never find anywhere else.

-

High-End Retailers: If you're after a new, signed piece from a powerhouse like Cartier or Van Cleef & Arpels, your safest bet is buying directly from one of their boutiques. You’ll walk away with the original box, papers, and all the official documentation.

The single most critical element in any purchase is the paperwork. An appraisal is just an opinion of value. A GIA certificate, on the other hand, is a verifiable statement of fact about a gemstone's quality.

Never, ever underestimate the power of a paper trail. A GIA certificate for a diamond or the original sales receipt for a signed piece creates an undisputed baseline for its identity and value. This makes it infinitely easier to insure and, eventually, to sell.

Strategies for Selling Your Jewelry

When the time comes to sell, the name of the game is maximizing your return. One of the most common and costly mistakes is rushing the process. The right sales channel really depends on what you have and how quickly you need to sell.

Let's look at the three main routes:

-

Consignment: This is where you entrust your jewelry to a dealer who sells it for you in exchange for a commission, usually somewhere between 20-40%. You'll often get a higher net return this way because the dealer is motivated to secure the best possible price.

-

Auction: If you have something truly rare or in high demand, an auction can spark a bidding war that drives the price well above expectations. But it’s not a sure thing, and the auction house fees can take a serious bite out of your profit.

-

Private Sale: Selling directly to another collector can sometimes yield the highest return simply because there’s no middleman. This path requires more legwork—you have to find the right buyer and have flawless documentation to prove your piece's authenticity and value.

For those just starting to build a collection, exploring pieces that balance timeless style with accessible value is a fantastic entry point. For example, these 14k gold-filled freshwater pearl drop earrings are a perfect example. They offer classic appeal backed by quality materials, embodying the kind of foundational piece a smart collection is built on.

Debunking Common Jewelry Investment Myths

When you start looking at jewelry as an investment, you'll run into a lot of "common knowledge" that's just plain wrong. These myths can be expensive, turning what you thought was a smart buy into a financial disappointment. Let's clear the air and tackle some of the biggest misconceptions head-on.

The biggest trap people fall into? Believing the retail price tag has anything to do with investment value. The second you buy a piece of jewelry from a typical retailer, its value can plummet by 50% or more. That's because you're not just paying for the piece; you're paying for the store's rent, marketing budget, and profit margin.

The real test of an investment happens on the secondary market, which couldn't care less what you originally paid. It only values the raw materials, the craftsmanship, and the actual demand for that specific piece. For jewelry to be a true asset, its resale value has to stand on its own two feet.

Myth 1: All Diamonds Are a Great Investment

This is a particularly dangerous myth. The truth is, the vast majority of diamonds are not investment material. Think about the diamonds you see in a typical mall jewelry store—they're mass-produced and have almost no resale value to speak of. They're pretty, but they aren't assets.

An investment-grade diamond is an entirely different beast. It's incredibly rare, boasting top-tier ratings across the 4 Cs—usually D-F color and VS1 clarity or higher—and always comes with a GIA certificate. Their value holds steady because their quality is impeccable and, most importantly, they are exceptionally scarce.

Think of diamonds like cars. A standard sedan gets you from point A to point B, but it depreciates quickly. A rare, limited-edition Ferrari, however, appreciates because of its scarcity and pedigree. The same principle applies to diamonds.

Myth 2: Trendy Designer Pieces Always Appreciate

Signed pieces from legendary design houses are often fantastic investments, but you have to be selective. Not all designer jewelry is created equal. A brand's trendy, seasonal collections can fall out of style just as quickly as they came in, causing their value to tank on the resale market.

The secret is timelessness. Look for iconic designs that have transcended generations. A piece like the Cartier Love Bracelet or a Van Cleef & Arpels Alhambra necklace holds its value precisely because its appeal isn't tied to a fleeting fashion moment. These have become cultural mainstays.

When you're looking at a designer piece, always ask yourself: is this a fad, or is this a classic with proven staying power? Sticking to those iconic signatures is how you build a truly valuable collection.

Your Questions About Jewelry Investing Answered

When you start thinking about jewelry as an investment, a lot of practical questions naturally pop up. Making smart moves here means getting clear, straightforward answers. So, let's tackle some of the most common questions to give you the confidence you need to build a collection that's not just beautiful, but valuable.

Think of this as a quick-reference guide. We'll reinforce the key ideas we've covered and make sure you feel ready to see jewelry as a tangible asset with real staying power.

Is It Better to Invest in Gold Bullion or Gold Jewelry?

This one really comes down to what you're trying to achieve. Gold bullion—the bars and coins—is a straight-up commodity play. Its value is tied directly to the daily spot price of gold. It's easy to buy and sell, but you can't exactly wear a gold bar out to dinner.

Investment-grade gold jewelry, however, has a value that's layered. First, you have the intrinsic value of the gold itself. But on top of that, you have the premium added by craftsmanship, brand heritage, or historical significance. A plain gold chain will always be worth its weight in gold, but a signed piece from a legendary house like Cartier could be worth multiples of that.

For pure, simple exposure to the price of gold, bullion is the winner. For an asset that you can actually wear and enjoy—one with the potential to grow in value far beyond its raw materials—carefully chosen jewelry is the smarter path.

How Much of My Portfolio Should I Allocate to Jewelry?

Most financial advisors will tell you that jewelry falls into the category of "alternative" or "treasure" assets. Its main job in your portfolio isn't to replace your stocks and bonds, but to add a layer of diversification. It’s a fantastic way to store value and protect your wealth against inflation.

A good rule of thumb is to allocate a small slice of your portfolio, usually around 1-5%, to tangible assets like jewelry, fine art, or other collectibles. This is a long-term strategy focused on preserving value, not chasing quick flips.

And remember, jewelry isn't like a stock you can sell in seconds. Only invest money you're comfortable locking away for the long haul.

Are Lab-Grown Diamonds a Good Investment?

As things stand today, lab-grown diamonds just aren't investment pieces. While they are chemically and visually identical to natural diamonds, their entire value proposition is different, and it's not one that lends itself to long-term appreciation.

The problem is simple: supply. The technology to create lab-grown diamonds is constantly getting better and cheaper, meaning the market is flooded with them. This continuous supply pushes their prices down over time, and their resale value is practically non-existent compared to natural diamonds.

The investment value of a natural diamond is built on one unshakable foundation: rarity. It's a quality that took billions of years to create and can't be duplicated in a lab. Without that fundamental scarcity, lab-grown diamonds are a poor choice for anyone hoping to see their collection grow in value. They are beautiful for everyday wear, but they simply don't work as a store of wealth.

At Fluent Trends, we're passionate about timeless pieces that blend exceptional quality with enduring style. Explore our curated collections to find the perfect starting point for your own investment-worthy jewelry wardrobe. Discover your next treasure at fluenttrends.com.